Q2 Earnings Highlights: AMETEK (NYSE:AME) Vs The Rest Of The Internet Of Things Stocks

Taking a look back at the Q2 earnings net, we examine the quarter’s best performers, including AMETEK (NYSE:AME) and its peers.

Industrial Internet of Things (IoT) companies are driven by the global trend of an increasingly connected world. They often specialize in startup areas such as logistics and factory automation services, fleet tracking or smart home technology. Those who play their cards right can generate recurring revenue by offering cloud-based software services, powering their network. On the other hand, if the technology these companies have invested in does not advance, they may have to make expensive pivots.

7 of the networks we track reported a weak Q2. As a group, earnings missed analysts’ consensus estimates by 1.9% while revenue guidance for the next quarter was 3.4% below.

Stocks, especially stocks with cash flow to the future, had a good end to 2023. On the other hand, this year there were many unstable market changes of funds due to mixed inflation data, and the commodity network has had many problems. . Overall, share prices are down 5% since the latest earnings results.

AMETEK (NYSE:AME)

Started from humble beginnings in automotive repair, AMETEK (NYSE: AME) manufactures electronic devices used in industries such as aerospace, energy and healthcare.

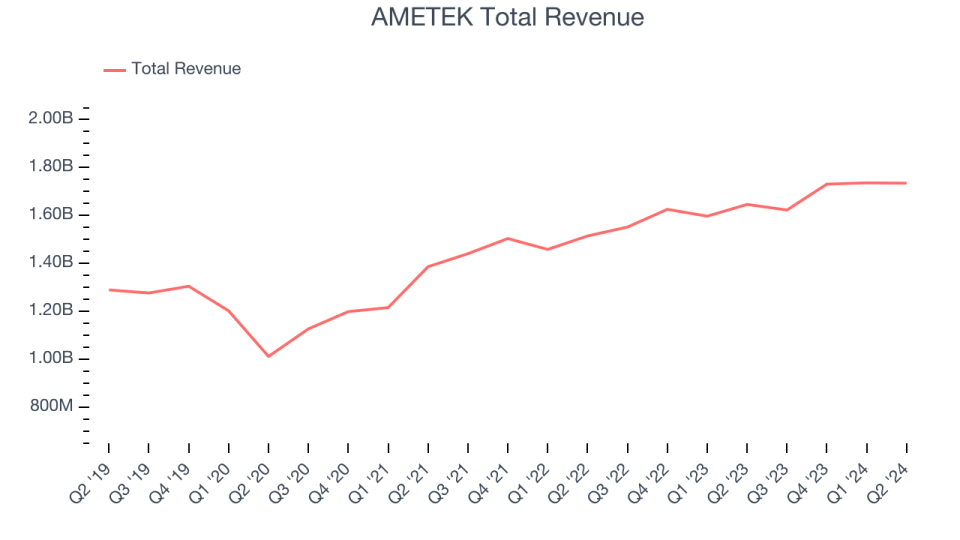

AMETEK reported revenue of $1.73 billion, up 5.4% year-on-year. The issue fell short of analysts’ expectations by 2.6%. Overall, it was a weak quarter for the company that missed analysts’ revenue estimates and lower earnings guidance for the full year.

“Our operating performance in the second quarter was strong with exceptional top-line growth, record operating income and EBITDA, and earnings growth ahead of our expectations,” said David A. Zapico, AMETEK Chairman and CEO.

Not surprisingly, the stock is down 6.9% since the report and is now trading at $161.48.

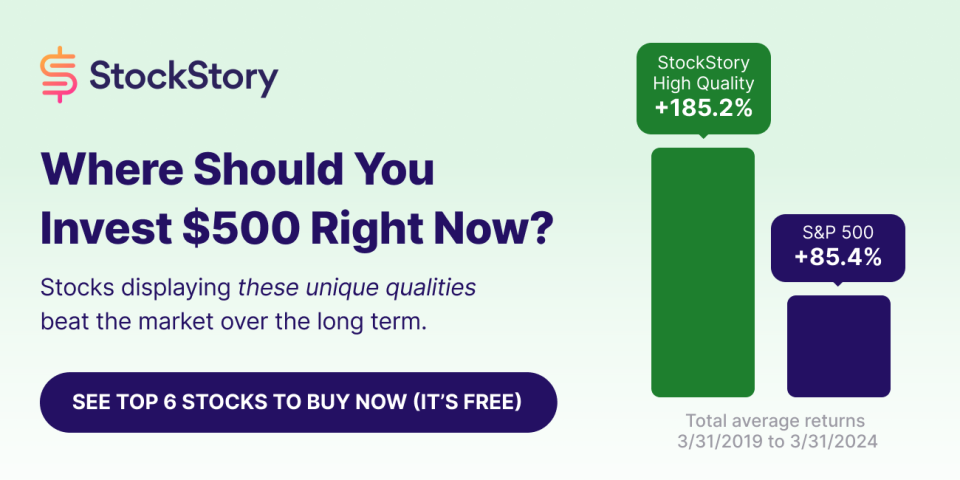

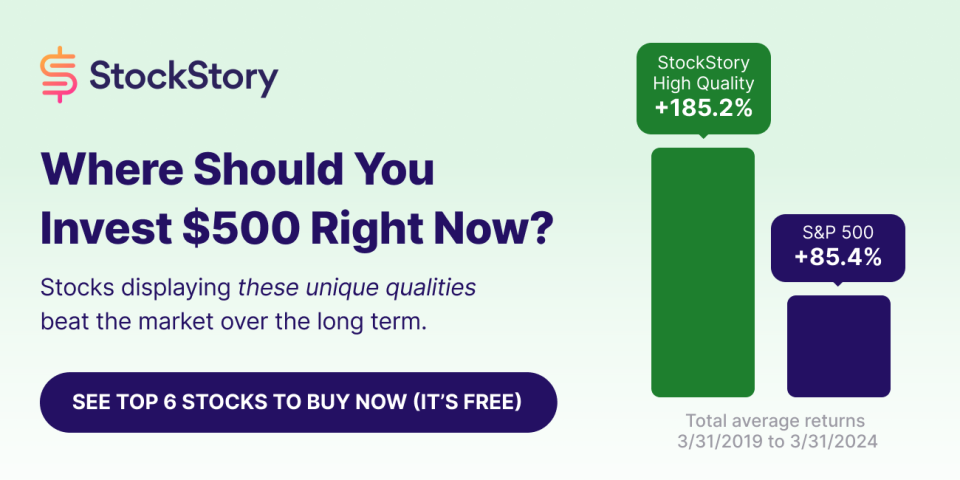

Is now the time to buy AMETEK? Get our full earnings results analysis here, it’s free.

Best Q2: Rockwell Automation (NYSE:ROK)

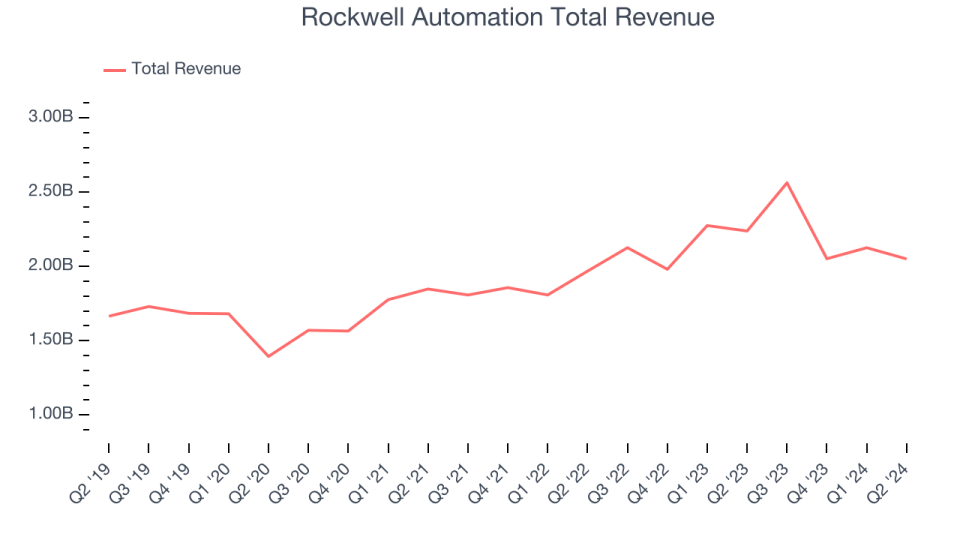

One of the pioneers in industrial automation, Rockwell Automation (NYSE:ROK) sells products that help customers get more out of their machines.

Rockwell Automation reported revenue of $2.05 billion, down 8.4% year over year, in line with analyst expectations. It outperformed its peers, but it was unfortunately a mixed quarter for the company with positive analysts’ revenue estimates but lower earnings guidance for the full year.

The market seems satisfied with the results as the stock is up 4.2% since the report. It is currently trading at $261.17.

Is now the time to buy Rockwell Automation? Get our full earnings results analysis here, it’s free.

Weakest Q2: Vontier (NYSE:VNT)

A recent development, Vontier (NYSE:VNT) provides electronic products and systems to the transportation, automotive and manufacturing sectors.

Vontier reported revenue of $696.4 million, down 8.9% year over year, missing analysts’ expectations by 6.7%. It was a weak quarter for the company with revenue guidance for the next quarter missing analysts’ expectations and analysts’ earnings estimates.

Vontier underperformed against analyst estimates for the team. As expected, the stock is down 13.9% since the results and is now trading at $33.80.

Read our full review of Vontier’s results here.

SmartRent (NYSE:SMRT)

Founded by an employee at a real estate rental company, SmartRent (NYSE:SMRT) provides smart home devices and software for multi-family residential properties, single-family rental properties, and apartment communities. of students.

SmartRent reported revenue of $48.52 million, down 9.1% year-over-year, missing analysts’ expectations by 6%. On the upside, it was a weak quarter for the company that beat analysts’ earnings estimates.

The stock is down 10.8% since reporting and currently trades at $1.48.

Read our full, practical report on SmartRent here, it’s free.

Emerson Electric (NYSE:EMR)

Founded in 1890, Emerson Electric (NYSE: EMR) is an international technology and engineering company that provides solutions to the industrial, commercial and residential markets.

Emerson Electric reported revenue of $4.38 billion, up 11% year over year, missing analysts’ expectations by 1.3%. Overall, it was a weak quarter for the company that fell short of analysts’ earnings estimates.

Emerson Electric pulled the fastest revenue growth among its peers. The stock is down 4% since reporting and currently trades at $103.49.

Read our full, practical report on Emerson Electric here, it’s free.

Contact Paid Investor Research

Help us make StockStory useful for investors like you. Join our paid user survey and get a $50 Amazon gift card for your feedback. Register here.

#Earnings #Highlights #AMETEK #NYSEAME #Rest #Internet #Stocks