IonQ: The Unproven Leader in Uncertain Computing (IONQ)

Only_Super/E+ via Getty Images

Introduction

Quantum computing is ideal for high-level tasks such as simulations and data analysis. Quantum computing has attracted interest due to its rapid evolution in solving complex problems. However, the technology has generated mixed feelings for investors who are wondering whether quantum computing has as much money as its hype with its unsolved flaws. IonQ (NYSE: IONQ), the main inventor of ion quantum computers, entered the dawn of the quantum age. IonQ develops quantum computers with charged ions like qubits that lasers use to solve complex problems.

For a disruptive technology like this, the investor must decide whether the company is successfully developing the technology for growth, and whether the business and profitability are there. Based on our analysis, IONQ’s development in both areas is “no”. So, it’s a bargain for us.

Quantum computing is still far ahead and can’t live up to its hype

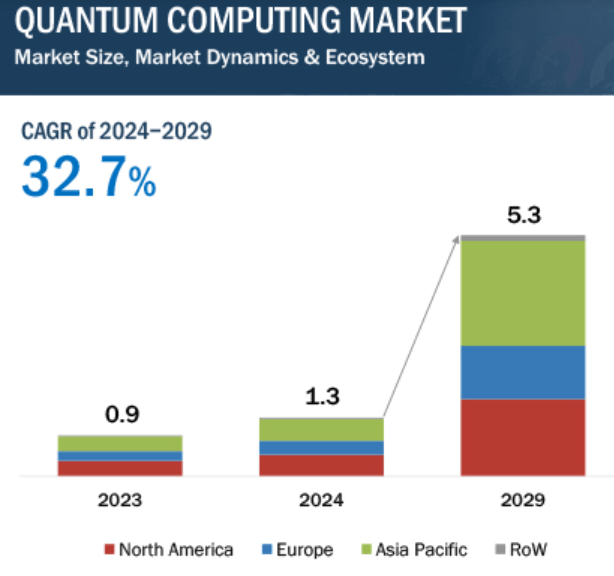

In my opinion, the predicted growth of the quantum computing market from 1.4 billion in 2024 to 5.3 billion in 2029 is overly optimistic due to technical and technological constraints a business that did not win.

Quantum Computing Market

According to McKinsey, quantum technology could be worth billions of dollars in the next 10 years. However, there is no certainty when the main problems will be solved. There are several reasons why 32.7% growth is excessive:

Unsolved errors in quantum computing

Companies in the quantum computing business are finding a way to solve the formidable challenge of quantum errors. As engineers promise exciting performance, quantum computers are still in the research and development phase. Now you can repeat when the head of AI research of Meta, Mr. Yann LeCun, says that there is a possibility that the benefit of quantum computers has been created.

Currently, there is a lot of hype in the industry, which makes it difficult to filter the opportunity from the unrealistic estimates. With this hype, quantum computers are still prone to errors, sending a warning to technology investors.

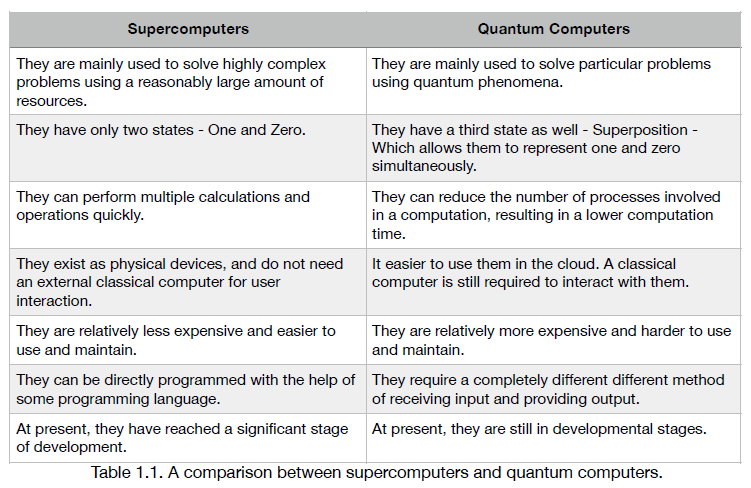

Still not better than supercomputers

Here are the differences as to why supercomputers are currently better than quantum computers, hence the hype.

-

Supercomputers are better at calculating exact and deterministic solutions than quantum computers.

-

Supercomputers can deliver more processing in seconds, while quantum computers are slower, with the hype unwarranted.

-

Supercomputers work differently and solve many problems at once, while quantum computers are used for challenges that supercomputers fail to solve.

-

The scalability of supercomputers is limited by financial constraints, while the scalability of quantum computers is still under investigation, leading to the concern of ‘why the hype?’

Data Analysis Report

For example, IonQ’s biggest challenge is scaling up its quantum computers. As a result, quantum computing lags behind the competitive advantage of supercomputers. As a technology investor, you should be concerned about why the hype exceeds the response to the challenges to existing quantum computers. The hype promises more research to speed up computing, but the invention of a quantum computer is still under basic research.

IonQ acknowledges the limitations of quantum computing

IonQ news in a recent announcement acknowledged their commitment to further quantum computing research. In the publication, the researchers note the fact that quantum computers are error-correcting. The closest IonQ researchers have come up with to reduce errors is a new noise reduction technique called Clifford gates.

Clifford Noise Reduction (CLINR) uses 3.1 qubit overhead, which is an improvement compared to other quantum devices that require hundreds or even thousands of qubits to correct an error.

Now you can understand how IonQ realizes that quantum computing has not yet achieved error reduction, contrary to the hype. Clearly, the predicted results are unrealistic.

John Preskill states that quantum computers are subject to intermediate-scale quantum noise (NISQ). It means that they are in progress, waiting for perfection for a meaningful benefit. Keep in mind that since error correction remains a fundamental challenge until error-correcting codes are developed, quantum computers cannot provide a predictable pattern.

Quantum advantages are not yet satisfactory, but improvements are making quantum computing more profitable. However, the hype loses its meaning considering the existing technical questions regarding the hardware. For example, there is still a technical need for more qubits for better control of devices.

IonQ President and CEO Peter Chapman says that achieving a new approach to error correction will be the frontier of quantum computing delivery of scale, performance, and solutions to many complex problems. As a leader in quantum computing error reduction, IonQ takes quantum computing problems into account. The computer requires more data samples to be processed, increasing the time to generate the solution.

These fundamental issues make quantum computing even more extreme than it already is.

The company is far from commercial

The IonQ business is far from over. The promotion and development of quantum computers is the first distinguishing feature of their business. The research phase includes the addition of more qubits for better control of the devices, which is not easy.

IonQ tried to solve the error problem by using next-generation barium qubits to increase the accuracy of the quantum system when solving complex problems.

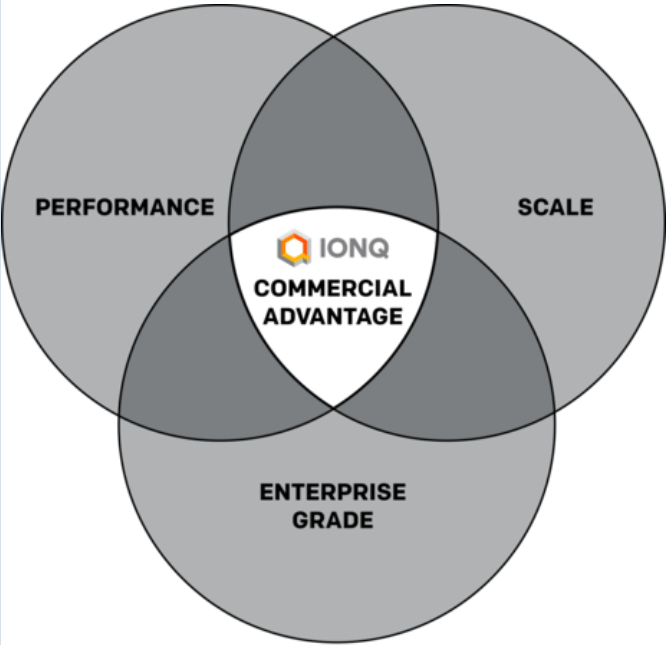

IONQ

IonQ quantum computers are still in the early stages of research and development. The company’s business data shows that IonQ has been funded by Congress $40 million under the US national security priority access to design the first-generation computers. Government funding shows that companies are struggling to do business.

According to Dean Kassmann, SVP of Engineering & Technology at IonQ, the market demand for enterprise computing is huge. The company is accelerating its quantum computing strategy. For example, IonQ combines photonic communications, multicore parallelism, novel technology, and systems engineering to deliver scalable, high-performance, and enterprise-class computing.

IonQ has not yet found a good business opportunity, but is working on an infrastructure expansion plan in partnership with other industry leaders. For example, IonQ has contracted with AWS to provide its world-class computers under the Amazon Bracket.

Value for money

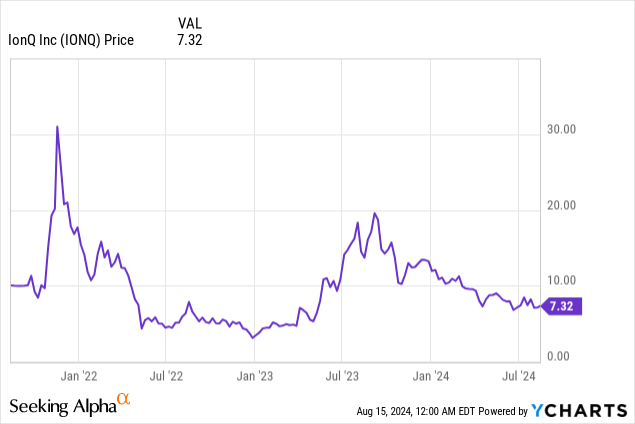

The company reported a significant decline from its peak near the $20 level in 2023. This proved that investors know that IonQ traps are slower to react than superconducting circuits, especially after ‘a departure from its founder in Feb 2024. Ion traps are also increasing. badly because of their large geometry. These uncertainties have spooked investors, leading to a drop in stock prices. The research and development of quantum computing will change the world of computing as we know it, but only until the main problems are solved as discussed. Therefore, the components of the smart purchase, will be depressed.

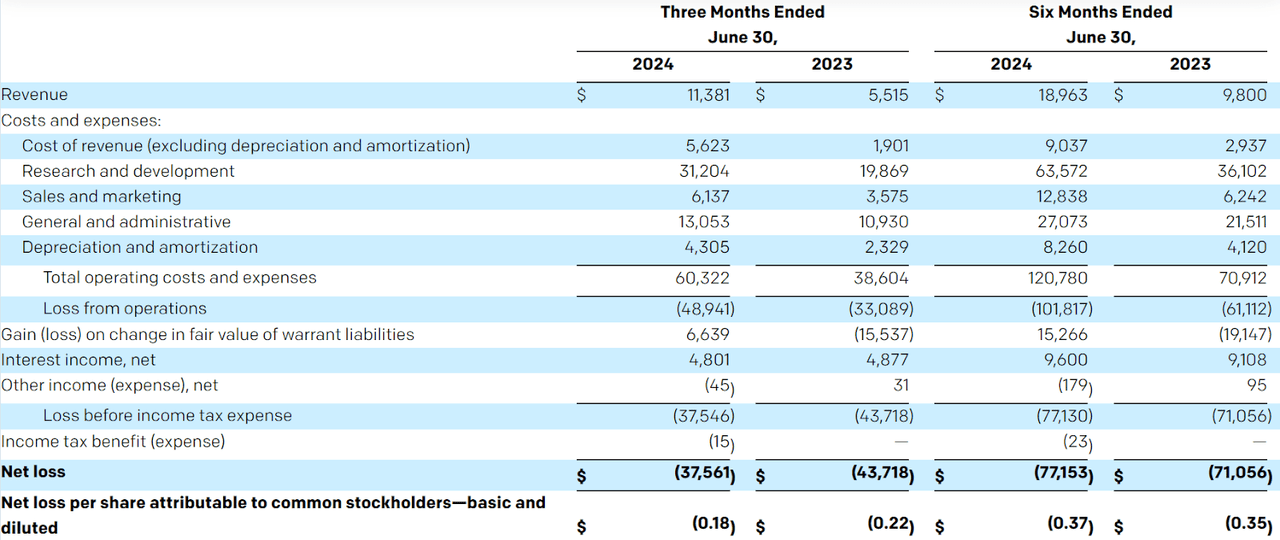

According to the latest financial highlights for the second quarter, IonQ’s financial performance reveals a negative view of net loss. The company has reported a net loss since 2023, with the latest Q2 loss at $37.6 million.

IONQ

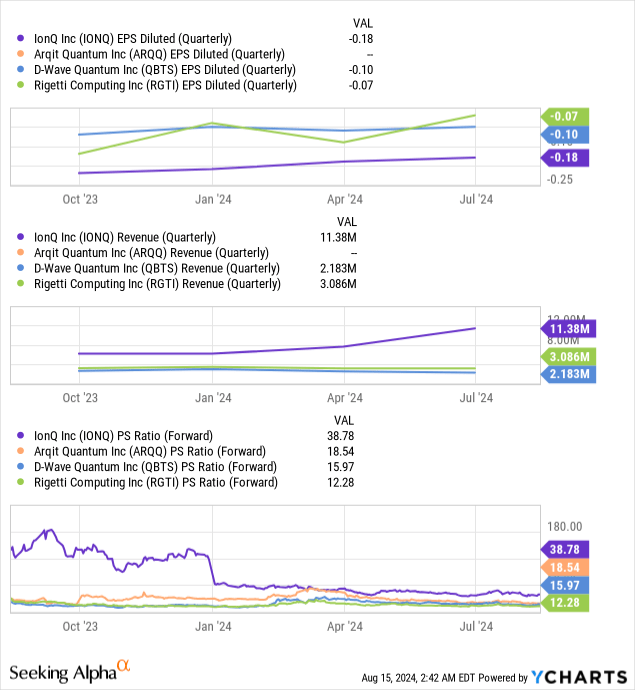

With an EBITDA loss of $ 23.7 million in the second quarter that has just been released, it has given a warning to investors who are willing to invest in the IonQ company. The latest announcement shows that the company’s shareholders will lose $0.18 per share. Estimated EPS was $0.11 compared to actual EPS of $0.209. Q3 EPS of -$0.12 would be more between -$0.140 and $0.209, as indicated by management.

Revenues performed better than expected, the second quarter recording $ 11.4 million above the $ 7.6 – $ 9.2 million forecast. This is a 105% growth compared to last year’s $5.5 million last year after the latest quantum algorithm update.

Conducting an educated analysis of a company’s target price, revenue and Price-to-Sales ratio will be a very important metric in terms of long-term profit prospects. Regarding revenue expectations, the consensus estimate of revenue ranges from $38 – 42 million. In most opinion, since IONQ has the highest trading capital compared to its peers, and when it is close to trading, it has a relatively high P/S ratio. In short, we expect quantitative easing to remain under pressure due to interest rates and slower-than-expected declines, as well as the removal of AI turbulence as indicated by the update. of Nvidia recently. Therefore, the company can be valued anywhere near the 25 – 30x range.

Therefore, the target price will be around $5 – $5.4, which represents a drop of more than 20%. So, it’s a Sale for us.

Investment Risk

-

High market volatility: IonQ’s price is down 61% in the last 52 weeks. The company has a steady increase in revenue and value. This could create a buying opportunity for the investor if the algorithmic IonQ quantum computing technology works. However, at the moment, it is risky to invest in IonQ shares and the current volatility.

-

Net profit: IonQ reported a net loss of $37.6 million in the latest Q2 announcement. The company relies on the sale of goods as a source of funds to support its operations. The operation reported a loss of $ 48.941 million in the latest Q2, showing that it is indeed a risky strategy.

-

The technology is still in its infancy: Quantum computing is still under research and development. The IonQ computer system is noisy, produces soft results, and is prone to errors. The company is also struggling to commercialize its technology.

#IonQ #Unproven #Leader #Uncertain #Computing #IONQ