Big Users: Almost Two-thirds of Gen Z Spend More When Using Digital Wallets

Digital patches they to change quickly payments countrywith predictions that they will pass debit cards to transaction value within three years. This change highlights the role of digital wallets not only as a payment option but also as a flexible tool that enhances customer engagement and spending.

It just passed PYMNTS Wisdom report, “Top of Wallet: Digital Wallets’ Ascent for Payments — and More,” in partnership with Admission Feesexamines how digital wallets have become widespread, providing merchants with the opportunities and challenges of adapting to this trend.

Growing Popularity and Burning Money

Digital wallets are on track to surpass credit cards in transaction volumes at retail by 2027, according to a recent report. The world’s prize report. The report reveals that digital wallets are used by 53% of Americans and are set to control nearly half of all point-of-sale (POS) transactions worldwide by the end of the decade. The value of transactions made through digital wallets is expected to double from 15% to 31% by 2027, while the value of debit card transactions will decrease from 28% to 23% in the same.

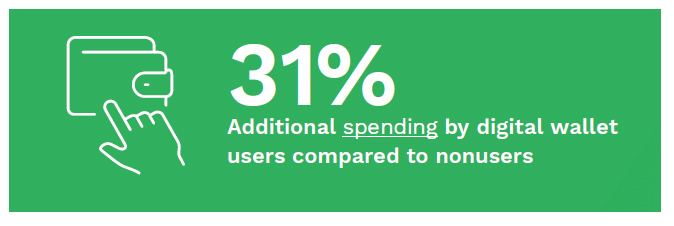

The driver of this trend is the convenience of digital wallets, leading to increased consumer spending. Digital wallet users, on average, spend 31% more than those who use other payment methods. This method is very popular among the younger generations, with 60% of Gen Z and 51% of a thousand years report higher spending when using digital wallets. High earners too show a tendency spending more money on digital wallets, with 61% of people earning more than $150,000 annually showing increased spending.

Merchant Adoption Lags

Despite clear consumer preference for digital wallets, merchant adoption remains inconsistent. Only 57% of small businesses accept digital wallet payments, compared to the almost universal acceptance of credit and debit cards. This gap provides an opportunity to businesses quick to adapt. Reluctance among retailers stems from concerns about the cost and complexity of technology upgrades, as well as fears about security and fraud.

It just passed JD Strength report highlights that 22% of merchants do not accept credit cards and 21% do not accept debit cards due to to worry about fraudwhich suggests a similar reluctance to digital wallets. The considering the complexity of integrating digital wallets into existing ones POS systems i the other wing. But The report notes that improving the Card readers with NFC capabilities it’s relatively inexpensive, with costs ranging from free to $500, depending on the provider.

Expanding Uses and Expectations

The functionality of digital wallets is moving beyond simple transactions. Consumers are interested in using digital wallets for different types of purposes, such as storing driver’s licenses, passports and event tickets. According to PYMNTS Intelligence, 45% of consumers are eager to use digital wallets for new money-handling options, including account transfers and recurring payments.

The demand for extended units is very strong among new customers, with 66% of Gen Z to show they would change suppliers to get new parts. This trend is proving to be beneficial for many consumers, with 37% of consumers willing to switch digital wallet providers for improved performance. Marketers need to realize that providing complete digital wallet services is not only to meet customer expectations but to prevent potential loss of business to competitors who offer advanced features.

Digital wallets are expected to surpass credit cards in transaction volume within a few years, driven by their convenience and increasing user usage. Marketers face challenges in using this technology due to security issues and the need for system development. To stay competitive, businesses must address these issues and improve digital wallet features to meet customer needs. As digital wallets become more popular, they will influence both payment methods and customer relations.

#Big #Users #Twothirds #Gen #Spend #Digital #Wallets